|

What’s the crossover between purpose and profit in sustainability? with Kevin Duncan and Sarah Duncan

What’s the crossover between purpose and profit in sustainability? with Kevin Duncan and Sarah Duncan

By Guest Contributors Kevin Duncan and Sarah Duncan

Authors of The Sustainable Business Book, Kevin Duncan and Sarah Duncan, share why the sustainability people and the commercial people should work together from the off to solve both a big social or environmental problem and a big business problem in one bold move.

Most businesses have never had a budget line dedicated to sustainability, so the idea of putting money behind it as a specific topic scares a lot of companies. The finance department doesn’t like it and doesn’t know where to allocate the cost. It’s not just the cost of reengineering physical elements of the business – there is also the human resource required to make changes and get jobs done.

It may sound tough, and it probably is, but you need to get used to it because the issue is not going to go away: you need to generate a budget for your Improvement Plan. This is the plan that takes into account all the progress you need to make on sustainability matters, maps it out, monitors progress, and enables the business to explain clearly what it is doing.

This means involving the money people from the off – whether that is your investors, your shareholders, your finance committee, a sceptical finance director or perhaps the head office in a global network. Similar to the world of innovation, it is easy to have hundreds of ideas on how to make the business more sustainable, but everything comes at a cost. Failing to address the financial implications at the beginning is unhelpful.

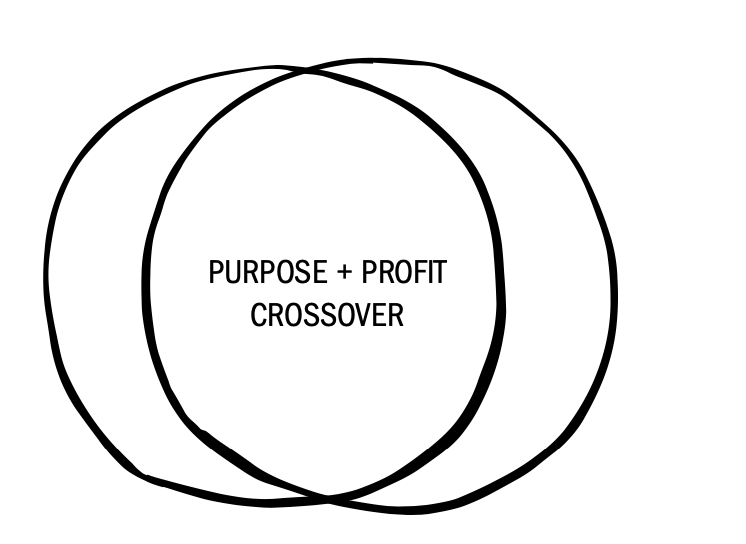

Instead, sustainability must build initiatives and programmes at the crossroads of purpose and profit.

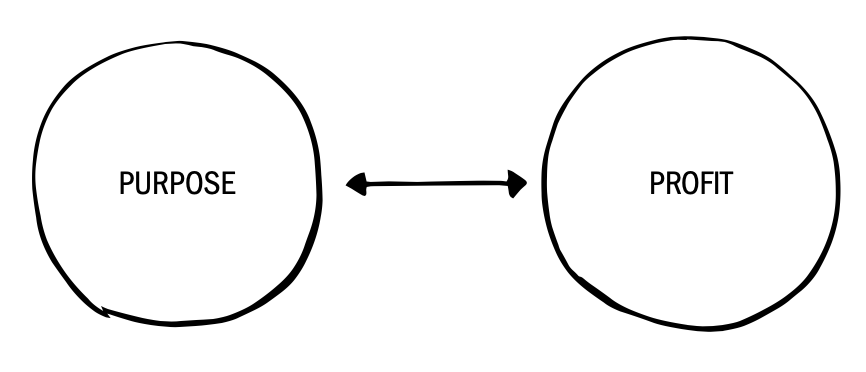

What goes into a sustainability process is usually dozens of initiatives competing for resources. Nearly all will have solved a social or environmental need, but they should always be balanced with solving a business need. The moral is: don’t suspend commercial questions early in the process. If you do, you will fall into the isolation trap (Figure 1).

The failure rate for sustainability programmes can be high, culminating in unicorns – visions that are lovely to think about but only doable and profitable in some imaginary world. What is needed is a pragmatic approach where the sustainability people and the commercial people work together from the off to solve both a big social or environmental problem and a big business problem in one bold move (Figure 2).

This two-sided thinking (sustainability need and company need) must be present from day one, because the best results appear at the crossroads of these two requirements.

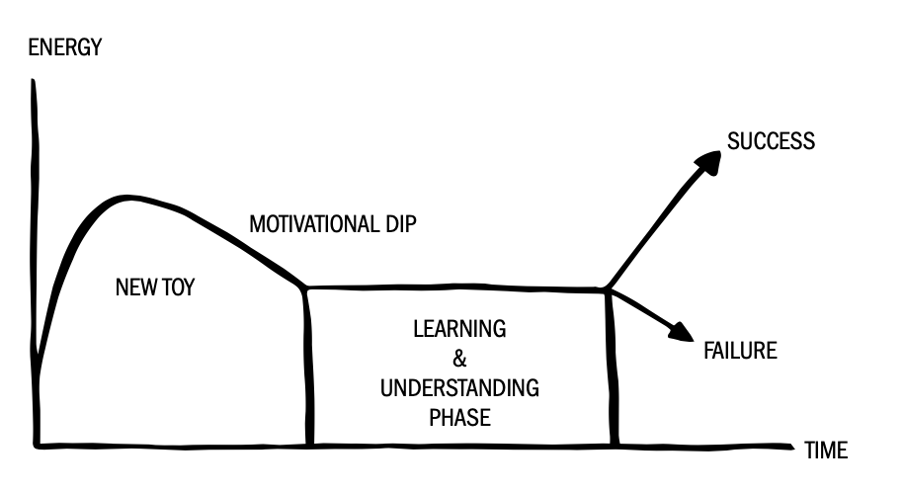

So that is how to start sustainability projects. As time moves on, almost every initiative or project loses momentum at some point. It’s human nature. We are very excited at the beginning but then the enthusiasm drops off. This can be described as the motivational dip (Figure 3). The interesting thing is that this phenomenon can always be predicted. So there is no point in pretending that it won’t happen. It is far more intelligent and effective to anticipate fizzle-out and build fail-safes into your plan from the start. Check-ins, reminders, incentives and sometimes even a quiet talking-to all play their part in keeping the plan on track. Be realistic about human motivation and get practical.

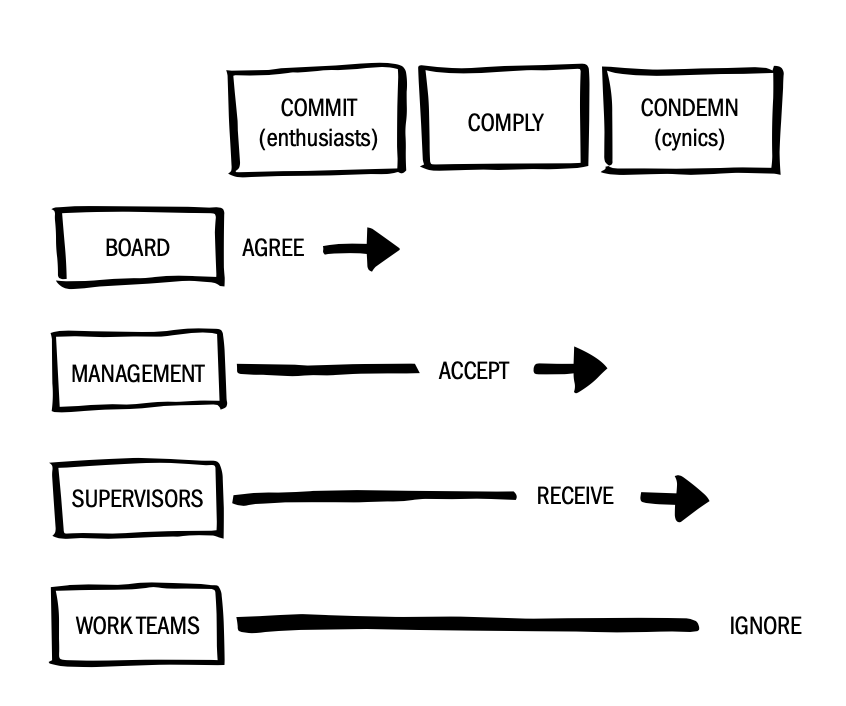

Sustainable commitment needs to run through the entire organization. Without robust and effective internal communication, principles can easily weaken in the face of day-to- day reality, as Figure 4 illustrates. This is often described as the strategy/execution gap.

Board enthusiasm means little if initiatives are met with cynicism on the front line. Strategies need to be fully explained to be successfully embraced at all levels of the business. Anticipate this and put measures in place to keep momentum going.

Adapted from Brand Manners (Hamish Pringle and William Gordon)

So now we have two morals for sustainability initiatives:

- Don’t suspend commercial questions early in the process and fall into the isolation trap.

- Anticipate fizzle-out by building in interventions to keep up momentum.

From The Sustainable Business Book by Kevin Duncan & Sarah Duncan

ABOUT THE AUTHORS

Kevin Duncan is a business adviser, marketing expert, and bestselling author. His books have been translated into over a dozen languages. He is the author of The Diagrams Book, The Ideas Book, The Excellence Book, The Smart Thinking Book, The Business Bullshit Book, The Intelligent Work Book, The Bullshit-Free Book and The Sustainable Business Book (all published by LID).

Kevin Duncan is a business adviser, marketing expert, and bestselling author. His books have been translated into over a dozen languages. He is the author of The Diagrams Book, The Ideas Book, The Excellence Book, The Smart Thinking Book, The Business Bullshit Book, The Intelligent Work Book, The Bullshit-Free Book and The Sustainable Business Book (all published by LID).

Sarah Duncan is a sustainable business development and ethical marketing consultant. She has been in business for over 30 years and set up her own consultancy, Sleeping Lion, in 2005. She now helps businesses navigate their way through the world of business ethics and sustainability with advice, support and bespoke workshops. She is the author of The Ethical Business Book (LID).

Sarah Duncan is a sustainable business development and ethical marketing consultant. She has been in business for over 30 years and set up her own consultancy, Sleeping Lion, in 2005. She now helps businesses navigate their way through the world of business ethics and sustainability with advice, support and bespoke workshops. She is the author of The Ethical Business Book (LID).

Suggested Reading

All businesses today face increasing pressure from customers and legislation to improve their sustainability credentials. Moreover, companies’ employees and shareholders are demanding the same. Yet, many companies are playing catch-up and urgently need to get on track for the future. This book explains how companies – small or large – can do that in a series of practical stages.

All businesses today face increasing pressure from customers and legislation to improve their sustainability credentials. Moreover, companies’ employees and shareholders are demanding the same. Yet, many companies are playing catch-up and urgently need to get on track for the future. This book explains how companies – small or large – can do that in a series of practical stages.

The authors adopt a method that asks a series of questions that then require brutally honest answers to, that then go on to develop guaranteed actions for companies to implement. For any business owner or manager who realize the importance of running a sustainable business, but do not know where to start, this book provides an essential springboard. It all adds up to a roadmap towards the next decade – and for businesses to remain relevant and resilient.