|

Why I Became an Entrepreneur with Per Wimmer

Why I Became an Entrepreneur

By Guest Contributor Per Wimmer

Author of The Sky Is No Limit, Per Wimmer, shares the four key reasons that made him become an entrepreneur.

I think there were three key things that led to my becoming an entrepreneur: my father’s example; the fact that I was one of the first Europeans to buy a ticket into space; and a meeting with an Australian called Tom in a London pub. None of these things has any real connection to the other.

First, my father. He grew up, as I would, in Slagelse, a small town in Denmark. He was one of eight children. My mother’s family had a small farm. My father’s father worked as a delivery man for a DIY chain and his mother worked as a cleaner at a local distillery. Money was short and sometimes there wasn’t enough food on the table. My father, like his brothers and sisters, left school early to start work and help with the family finances. His first job was working in a bicycle shop. When the bicycle shop became a car dealership, he learned new skills, rising to become head of the spare parts division and later head of sales. The company was badly run and got into difficulties and, when it was nearly on its knees, my father managed to raise the money to buy the company and run it himself. He turned it around and made it one of the most successful GM dealerships in Denmark. His example of hard work and determination and his focus on delivering great customer service stays with me to this day.

Next, that ticket for a trip into space. At one point, in the early 2000s, I was the proud and excited owner of three tickets to space. The first was with Space Adventures. The company still offer trips to the International Space Station (ISS) and are offering an amazing future trip to orbit the moon, but Space Adventures were offering flights to the ISS on board Russian Soyuz rockets and Russia’s Roscosmos programme never did develop to the new C-21 spacecraft that would deliver the suborbital flights I had bought a ticket for. My second ticket was with Richard Branson’s Virgin Galactic, whose commercial flights into space started in August of 2023. I bought my ticket back in 2004: it has taken a lot of effort for Virgin Galactic to make the dream a reality after the experimental SpaceShipOne won the Ansari-X prize for the first reusable commercial spacecraft to fly into space within two weeks, and Richard Branson announced the formation of Virgin Galactic and the commissioning of SpaceShipTwo. There has also been a tragedy: when VSS Enterprise, the first incarnation of SpaceShipTwo, crashed on a test flight in 2014, the co-pilot was killed and the pilot seriously injured. Getting to space has always been an arduous and a hazardous business; it is no different for the pioneering private space endeavours than it was for NASA or the Soviet space programme.

As one of Galactic’s Founding Astronauts, I drew lots with my fellow fliers to determine which flight I would be on, and I drew ticket No. 37 – which should put me on board the 10th commercial flight of VSS Unity, the successor to VSS Enterprise. Even with my two tickets to space in place, I bought a third, as an insurance policy, with a company called XCOR who were developing a wonderful rocketplane called Lynx. Sadly, XCOR went bust. We are still in the very early days of the private exploration of space; not all pioneering companies in this revolutionary new field have survived.

There are still only just over 600 people who have been into space. I have been an adventurer all my life, travelling the world, trekking the Inca Trail in Peru, taking part in a record-breaking skydive over Mount Everest and an attempt on the world landspeed record driving a converted jet fighter. The moment I heard it was possible to buy a ticket to space, back in 2000, I jumped at the chance. A trip into space will be my greatest adventure. Buying three tickets was a kind of insurance policy; I thought it highly likely that none of the planned private space ventures would succeed.

The reason my ticket to space helped me become an entrepreneur is not obvious. I was working at Goldman Sachs at the time. I hadn’t told my colleagues about my plans to travel into space, even though I was already travelling to Russia with Space Adventures, flying a MiG-25 fighter jet at an altitude of 80,000 feet and three times the speed of sound and doing other kinds of space training, such as high-G centrifuge training. But then Reuters posted a small piece about me going into space, and one of my colleagues at Goldman, a trader, copied and pasted the piece to everyone in Goldmans worldwide: 22,000 people. “Per Wimmer is going into space!”

At that point, it was obviously no longer a secret. I began to get invitations to give presentations about my adventures and my coming trip into space. I wanted to inspire young people, especially, to live out their dreams, whatever they may be, and to stimulate their interest in science and in space exploration. I clearly remember giving a presentation in the early days to a school in my hometown in Denmark, showing what must be the worst video in the world of me doing some of my astronaut training – grainy and shaky, with awful sound quality. But the kids loved it! I found it hugely inspirational myself to be able to offer them the feeling that all kinds of things may be possible in their lives. I formed my first entrepreneurial venture, Wimmer Space, to handle ongoing speaker engagements, my increasingly frequent media interactions and later my publishing interests and work on TV documentaries.

The third, slightly random event that pushed me further towards becoming an entrepreneur was that lunch in a London pub. I was working at Man Securities at the time and a mutual acquaintance told me about a senior executive, Tom, from an Australian oil and gas company who was in London looking to finance a $10 million deal. I had good contacts with some top institutional investors from my days at Goldman Sachs, and Man Securities worked in stockbroking, researching markets and presenting opportunities to clients, so there was no conflict of interest if I tried to help Tom find his $10 million.

Funnily enough, it can be easier to raise $100 million than $10 million, because a $10 million deal is too much for most individual investors and not enough to make it worthwhile for institutional investors to do all the necessary research. But I looked into Tom’s project, and I thought it had real potential. I used my personal contacts and my belief in the project to find Tom the funding he needed. He invited me to visit him and his family in Perth as a thank you, and I got to meet a lot of people in the Australian mining industry, which is mainly based around Perth. I facilitated a few more interesting deals and began to get a name as ‘the Danish rainmaker from London’ who could make things happen.

Back in London, I was finding my work with Man Securities increasingly restricting for my activities with Wimmer Space. Film crews making documentaries were following me around the office to record my daily working routine. One day, they insisted we move onto a Thames River cruiser so they could get some dramatic shots of the City of London from the river. I’ve always been good at handling a schedule that a lot of people would find daunting (one of the camera crew had to ‘retire hurt’ one morning after a late night with a certain amount of revelry and a very early start the next morning proved too much for his constitution) so my work performance never suffered. Man Securities were incredibly flexible and understanding and quite liked all the media attention! But I was beginning to find the conflict between commitments and my other interests frustrating. I wanted to be my own man and choose exactly how I spent my time. After a series of more “freelance” deal broking, often for my new Australian mining ventures, I launched my boutique investment bank, Wimmer Financial.

Now I must tell you a fourth reason why I became an entrepreneur, which is very important for anyone who dreams of starting their own business. The fourth reason was ignorance. Not ignorance of the financial business. I know the world of finance inside out. It was ignorance of the future – something we all suffer from.

Wimmer Financial launched on October 4th, 2007 – the 50th anniversary of the launch of Sputnik, the world’s first artificial satellite. October 4th is a big day for anyone involved in space and I wanted it to be the date I officially launched my new company. But in October 2007, like everyone else, I was completely unaware that just eleven months later Lehman Brothers would go bust, signalling the start of the near collapse of the entire global financial system and the onset of the Great Recession.

Wimmer Financial was a transaction-led business, and for six months after Black Monday there were no transactions. It was fortunate, with hindsight, that we had launched one year earlier and not on the eve of the crash. I was able to cut all non-essential expenditures to keep our burn rate to a minimum and, in the end, I had enough cash reserves to see us through. I had been very fortunate not to have had to take on any external debt to launch the company, so there was no one to cut off my funding or call in any debt.

By chance, my attempt at a world-record-breaking skydive over Everest was due to take place in late September 2008, just a few weeks after the crash. I thought about cancelling it to focus on the business, but there wasn’t really any business to focus on! There was not much point in sitting in London staring at the wall. I flew to Katmandu with a camera crew to record events as we hiked through the Himalayas to the drop zone at the tiny Syangboche airstrip in the foothills of Everest – the nearest airstrip to Everest itself. From Syangboche, our Pilatus Porter plane would take off and climb above Everest to a height of over 29,500 feet, and I would jump out and skydive over Everest before we opened our parachutes and glided back, with luck, to the drop zone. We made it, creating a new world record. And then I got back to business.

There were some big hurdles to face before we could get clear of the crisis and the ensuing credit crunch. Our regulatory umbrella company gave us notice they didn’t want our business in the current climate, and the lease on our office was coming to an end – which meant we were in danger of being an investment bank without a banking license or a place to do business from, facing the most difficult trading conditions for nearly a century. But we made it through.

It was difficult at the time to stare into the tunnel and not be able to see any light at the end of it. There are many dark days for any entrepreneur. But you fight on, and you focus on solutions; you don’t waste too much time debating the very best solution or trying to delay difficult decisions, you hit the issues straight on and figure things out. I have gone on to launch two other financial entities: Wimmer Family Office and Wimmer Accounting. Wimmer Space goes from strength to strength and works closely with charities such as UNICEF, Hospice Foundation, Ideas Foundation, ShareSpace, Global Angels and others to pursue its goal of helping young people realise their dreams.

There are, as I say, difficult times and dark days for any entrepreneur, but the freedom it gives you to set your own rules and do exactly what you choose to grow your business and follow your own dreams is exhilarating. Sometimes you make money; sometimes you lose money. But there isn’t a salary anyone else could offer me that would tempt me away from the freedom that comes with being an entrepreneur. That freedom is priceless.

My advice for budding entrepreneurs would be to remind yourself that you will never have perfect information. If you wait until everything is perfectly lined up and supposedly de-risked, you will probably never start your business. Think about likely worst scenarios and have a plan to weather those – and then jump in. At some point, you just have to go for it.

I am reminded of exactly that crucial point when I think back to the moment we climbed aboard the plane at the airstrip at Syangboche before our skydive over Everest. You’ve weighed all the risks, done all the preparation and done everything you can to mitigate the risks. But there comes a moment when you have to take that first step. Once you get on the plane, there’s no turning back. But if all goes well, it will be the experience of a lifetime.

ABOUT THE AUTHOR

Suggested Reading

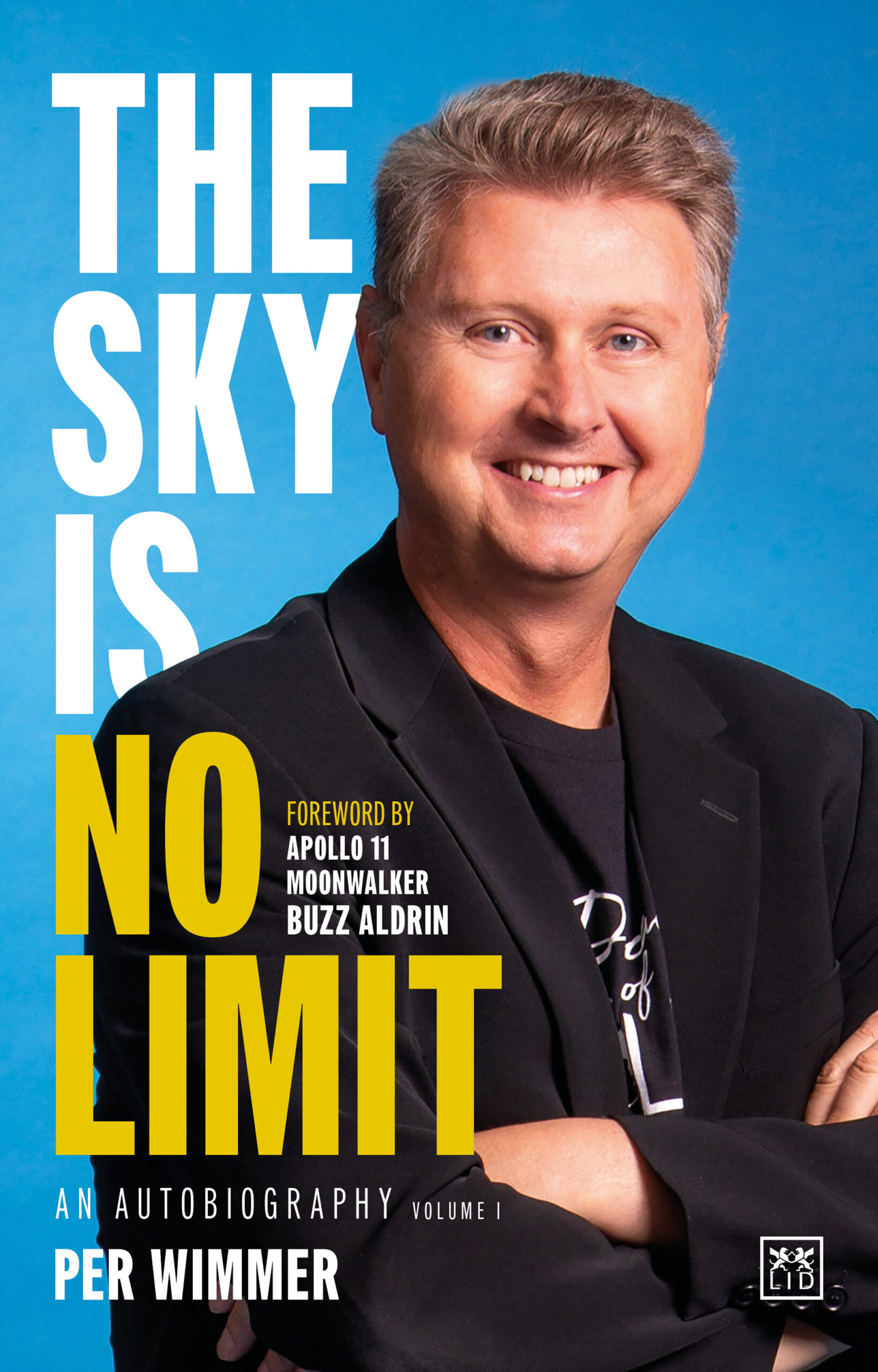

The Sky Is No Limit is the first volume in the autobiography of a person who a commentator described as “a true Indiana Jones meets 007 James Bond”. Per Wimmer’s life story is far from ordinary and very much driven by the desire to push boundaries. This first volume covers Per’s formative years, his growing fascination for adventure, travel and space, and the growth of his career in international finance, culminating in the founding of Wimmer Financial.

The Sky Is No Limit is the first volume in the autobiography of a person who a commentator described as “a true Indiana Jones meets 007 James Bond”. Per Wimmer’s life story is far from ordinary and very much driven by the desire to push boundaries. This first volume covers Per’s formative years, his growing fascination for adventure, travel and space, and the growth of his career in international finance, culminating in the founding of Wimmer Financial.

Per Wimmer is a global financier who founded investment management companies Wimmer Financial and Wimmer Family Office. Outside of work, he is an astronaut, adventurer and philanthropist. Danish in origin, Per lives mostly in London.

Per Wimmer is a global financier who founded investment management companies Wimmer Financial and Wimmer Family Office. Outside of work, he is an astronaut, adventurer and philanthropist. Danish in origin, Per lives mostly in London.